📈

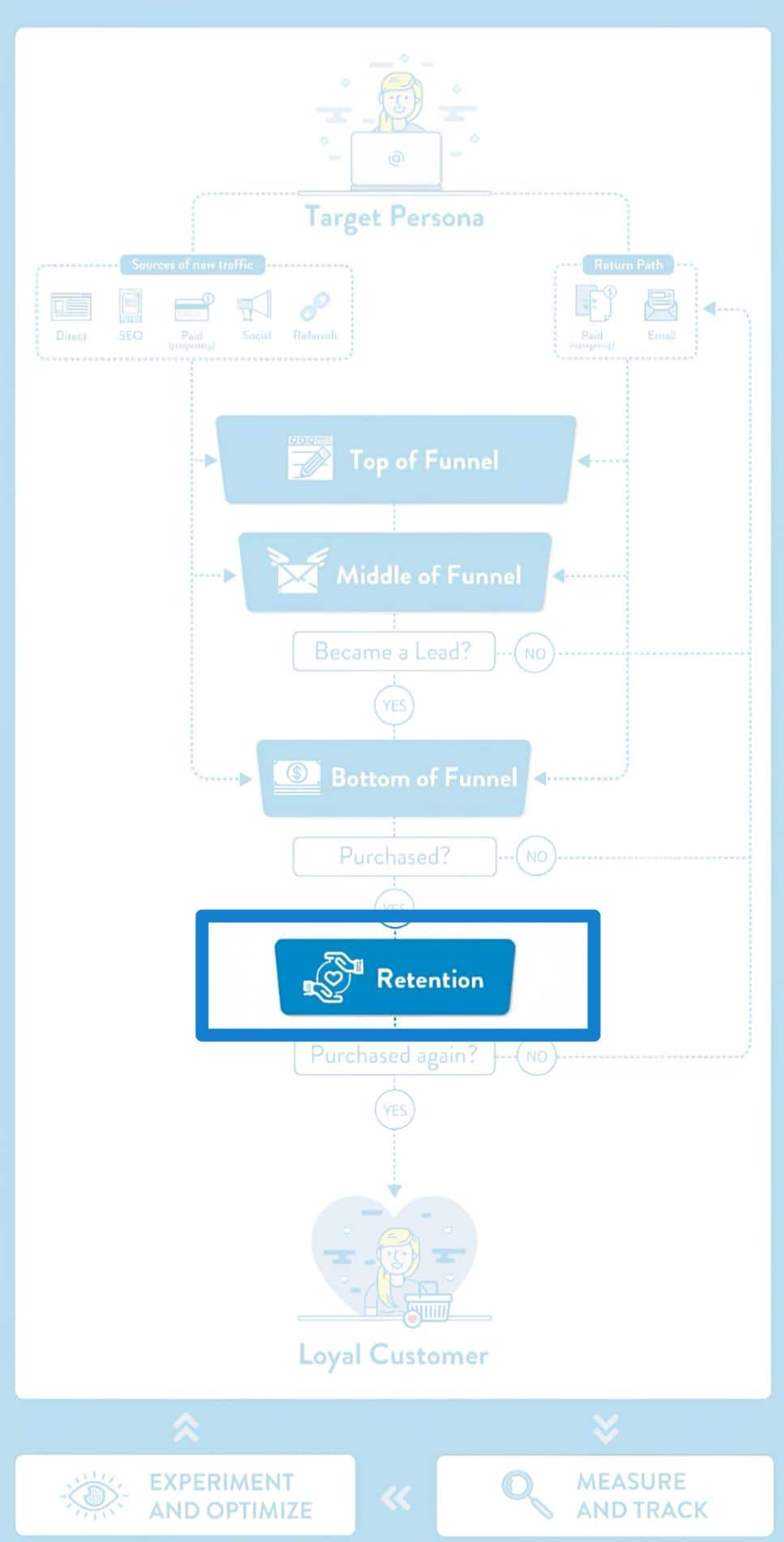

Your Goal at the Retention Stage: Increase Lifetime Value

In the retention stage, your marketing persona is already a customer of your product. Your objective is to increase the value you can extract from them directly by generating repeat purchases, upsells, or reducing churn; or indirectly by improving brand image or promoting referrals.

📝

Content Marketing

The objective of the content you'll create at the retention stage is to keep your existing customers happy by providing ongoing value (even after purchasing.)

Content ideas:

Monthly financial performance newsletter summarizing investment portfolio growth and strategies

Blog post: '10 Ways to Optimize Your Financial Planning in Retirement' providing continuous education for existing clients

Client success stories video series highlighting transformed financial situations thanks to ongoing advisory support

Interactive webinar: 'Staying On Track: How to Adapt Your Financial Plan Over Time' encouraging engagement with existing clients

Personalized annual financial check-in email campaign reminding clients about their financial goals and next steps

Exclusive access to an educational eBook: 'Advanced Investment Strategies for Existing Clients' delivered through email

What to measure:

Open rates on newsletters

Number of views on client success videos

Engagement metrics on webinars

🔎

SEO

At the bottom of the funnel, you'll want to make sure your marketing persona can find all the information she needs to get the most of your product (e.g. knowledge base articles), or to solve any problems that may arise (e.g. support/contact page.)

Keyword ideas:

financial planning for existing clients

how to adapt financial plans over time

importance of regular financial check-ups

advanced investment strategies

top financial planning tips for retirees

wealth management for high-income families

personal finance for retiring professionals

establishing trust with your financial advisor

impact of financial advisors on long-term investment results

What to measure:

Organic traffic to retention-focused content

Keyword rankings for client retention terms

🎯

Paid Advertising

At this stage of the funnel, you might choose to be run campaigns promoting of new features, upgrades, or promotions.

Target audience ideas:

[Remarketing] Facebook Ads: Target customers who have engaged with previous content about personal finance optimization

[Remarketing] Google Ads: Show ads to clients who visited account management pages urging them to attend the upcoming webinars

[Remarketing] YouTube Ads: Retarget viewers who engaged with success stories, promoting a new client testimonial video

[Prospecting] LinkedIn Ads: Target existing clients who haven't engaged with recent educational materials on financial planning

[Remarketing] Instagram Ads: Showcase testimonials from clients who benefited from the annual check-ins offered

What to measure:

Click-through rate on retargeted ads

Participation rates in retargeted promotions

Cost per engagement with client success stories

📱

Social Media

Retention campaigns on social media revolve around building a sense of community with your existing customers. You'll do a lot of monitoring of brand mentions on social media.

Social media campaign ideas:

Regular client spotlight posts on Instagram showcasing satisfied customers and their financial achievements

Host a live Q&A on Facebook addressing questions from current clients about ongoing financial strategies

Initiate Twitter discussions about common financial challenges retirees face, offering insights as a financial advisor

Create LinkedIn polls for existing clients to gather feedback on the types of services they value most

Monitor social media for mentions of advisory services, responding to any inquiries or concerns raised by clients

What to measure:

Engagement on client spotlight posts

Feedback collected from Twitter discussions

Reach of live Q&A sessions

📧

Email Marketing

Retention email campaigns will be a mix of educational emails (onboarding, activation, etc), transactional emails (reports, receipts, reminders, etc), and promotional emails (upgrades, upsells, etc.)

Email marketing campaign ideas:

Quarterly performance report emails providing personalized insights into client investments and updates

Follow-up email campaign post-webinar encouraging feedback and further inquiries about their financial plans

Client appreciation email: 'Thank You for Trusting Us with Your Financial Future!' with highlights of recent successes

Regular educational email series focusing on advanced strategies and updates in financial regulations

Holiday greeting email featuring tips for year-end financial planning, fostering ongoing engagement

What to measure:

Response rates on performance report emails

Engagement with follow-up emails

Client satisfaction ratings from appreciation email campaigns

🧪

Marketing Experiments

Your retention experiments will have the objective of maximizing lifetime value of existing customers.

Experiment ideas:

A/B test different subject lines for quarterly reports to see which sees higher open rates

Experiment with varying formats for client success stories to determine delivery effectiveness

Run a split test on webinar registration forms to reduce drop-off during sign-ups

Test sending email reminders about ongoing services to assess engagement improvements

Evaluate the impact of personalized content on social media engagement with existing clients

What to measure:

Open rates on test emails

Engagement metrics from webinars

Conversion rates from social media campaigns